What To Consider Before Meeting a Commercial Fire Insurance Adjuster

2/1/2021 (Permalink)

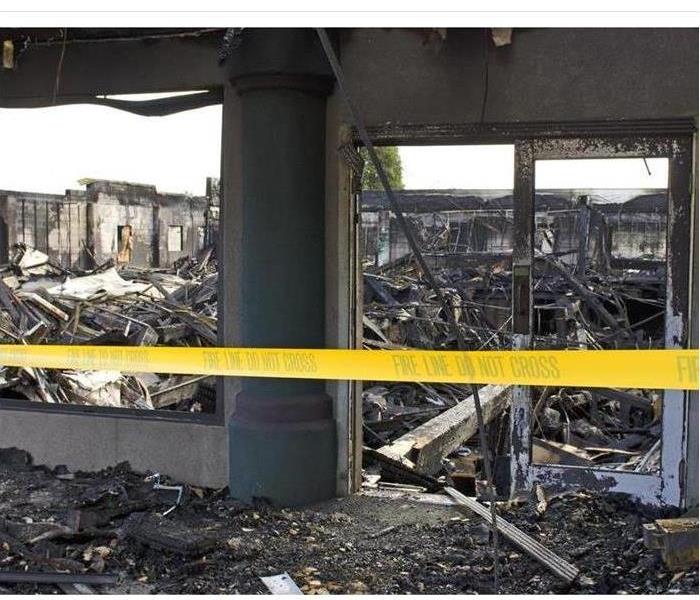

A blaze in your commercial building can be a stressful experience. The fire damage could appear overwhelming. While emergency restoration specialists can assist with the cleanup, you may need to file an insurance claim to pay for the remediation. This can lead to additional frustration. To help things go more smoothly, consider the following before meeting with your insurance adjuster.

Types of Damage

The heat and flames from a fire can harm various parts of your property. The water used to suppress the fire can cause damage, as well. The disaster could thus affect:

- The structural integrity of the building

- Important equipment

- Valuable electronics

Your adjuster will likely want proof of the damage to your building. Look for photos of the property that you took prior to the fire. You can then present those images alongside pictures from after the blaze. If you do not have any “before” pictures, use blueprints and receipts to demonstrate the previous structure of the building and the assets that were inside it.

Extent of Coverage

Ideally, your insurance will pay for most or all of the fire damage restoration. Unfortunately, that is not always the case. If your policy only offers limited coverage, try to get help from a public adjuster or your agent.

Trusted Contractors

Be sure to approve the contractors used by the insurance company before the repair work begins. Do not allow the insurer to hire workers who use dangerous materials such as lead or asbestos.

Required Documents

Finally, ask the insurance adjuster if you need to provide any additional documents as part of your claim. If the provider works with a forensic auditor, you may need to produce certain financial statements.

Before you make your fire damage claim, make sure that you understand your policy and gather the evidence and documents you need. You should also check that your insurance provider uses trusted and reliable contractors for the repairs. This should make the fire mitigation process more efficient.

24/7 Emergency Service

24/7 Emergency Service